- minute read

- minute read

Taxes can be a complicated – not to mention largely unwanted – business. Particularly if you’re a new landlord, getting your head around which taxes you’ll need to pay can take some doing. Missing just one out could result in an appointment with HMRC which we’d all rather avoid.

In this article, we’ve gone over all the taxes that landlords need to pay, along with claiming expenses, repairs and replacements, working out your tax, tax relief and managing your tax liability.

Note: The purpose of this guide is to provide a general overview of landlord tax. For more in-depth tax advice, we’d recommend you seek professional advice from a tax specialist.

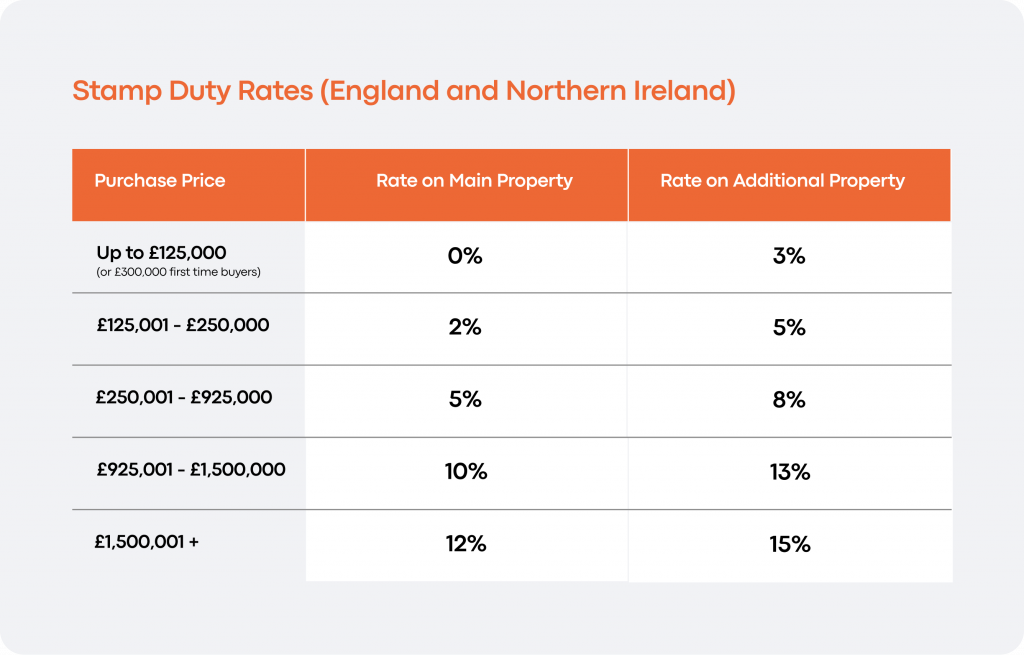

If you buy a property over a certain price in the UK then you’re eligible to pay tax on it. The exact amount of tax you pay depends on the value of the property, location and personal circumstances (we’ve gone into these tax rates by property price below).

As of March 2022, here are the stamp duty rates across the UK:

In England and Northern Ireland, no stamp duty is due on the first £125,000 of a property. If you’re a first-time buyer, then this threshold goes up to £300,000.

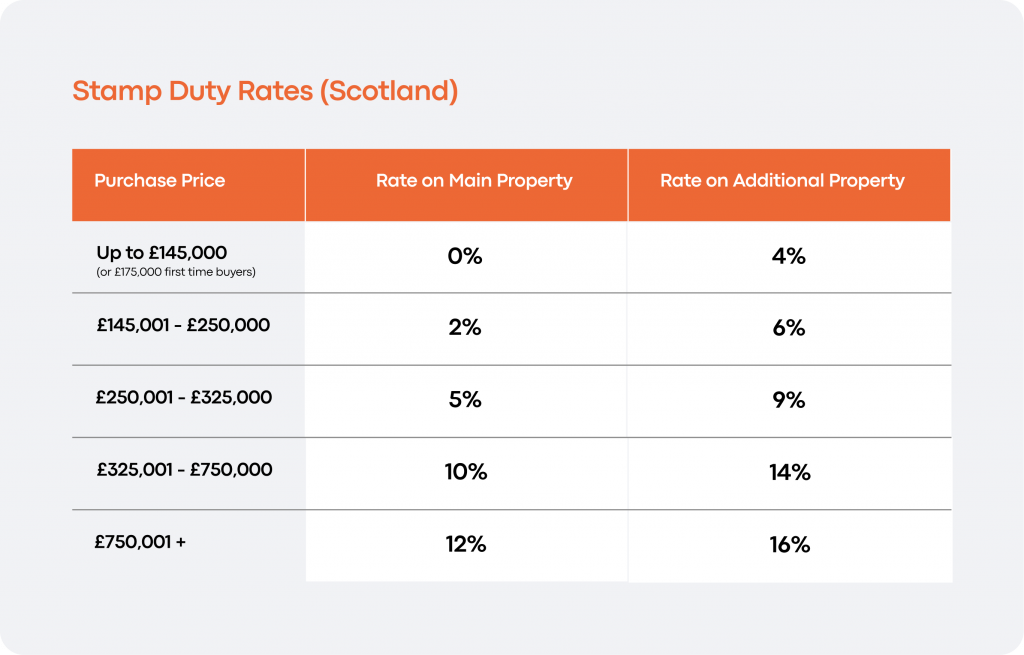

You can see that the Scottish thresholds are slightly different to England and Northern Ireland, with less relief being provided for first-time buyers but a slightly higher bottom rate at which stamp duty starts being due (£125,000 vs. £145,000).

It’s also worth knowing that in Scotland, any additional properties bought for less than £40,000 will be charged at the ‘rate on main property’.

Note: It isn’t called stamp duty in Scotland anymore. They now refer to it as ‘land and buildings transaction tax’.

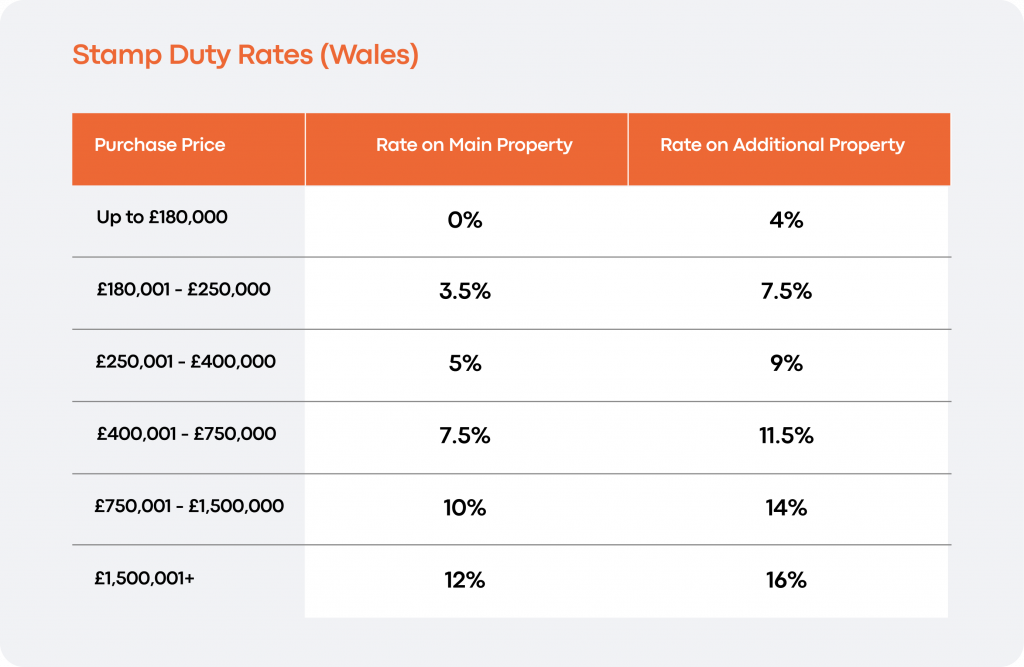

What’s different in Wales is that there isn’t any extra stamp duty relief for first-time buyers, with the boundaries also being slightly different to the rest of the UK.

Check out GOV.UK for more information on how to pay stamp duty.

Whoever benefits from owning a property pays property tax on it. In the case of landlords, this falls on them. Although, certain landlords factor this expense into the monthly rental amounts they charge tenants anyway.

Property taxes are based on the current value of your home, so can increase or decrease over time to reflect the new value of a property. As long as you own a property, you’ll pay property tax on it.

When making money from letting a property, you might have to complete a self-assessment tax return, depending on how much you’re earning.

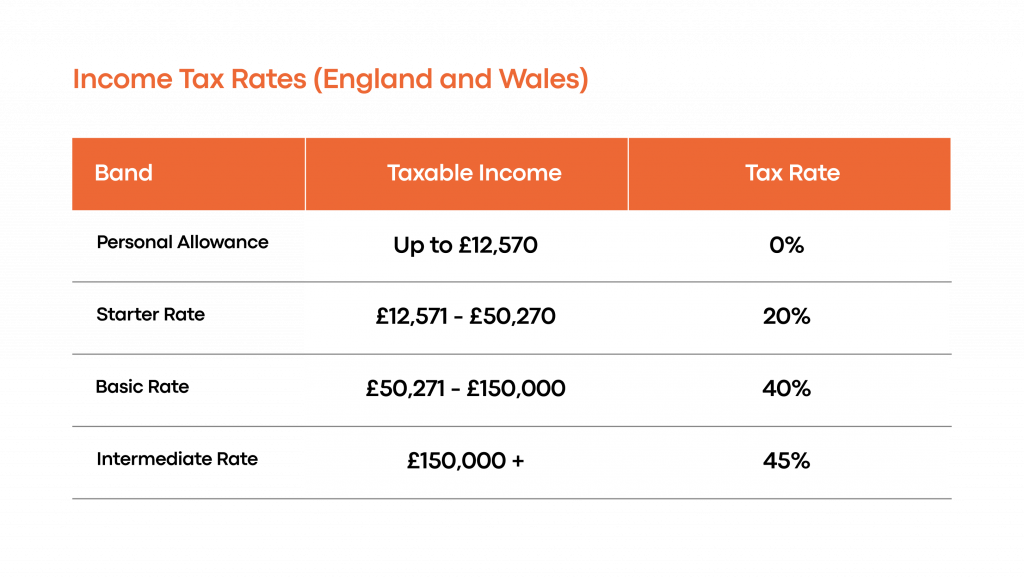

Here are the 2021/22 income tax rates for England and Wales:

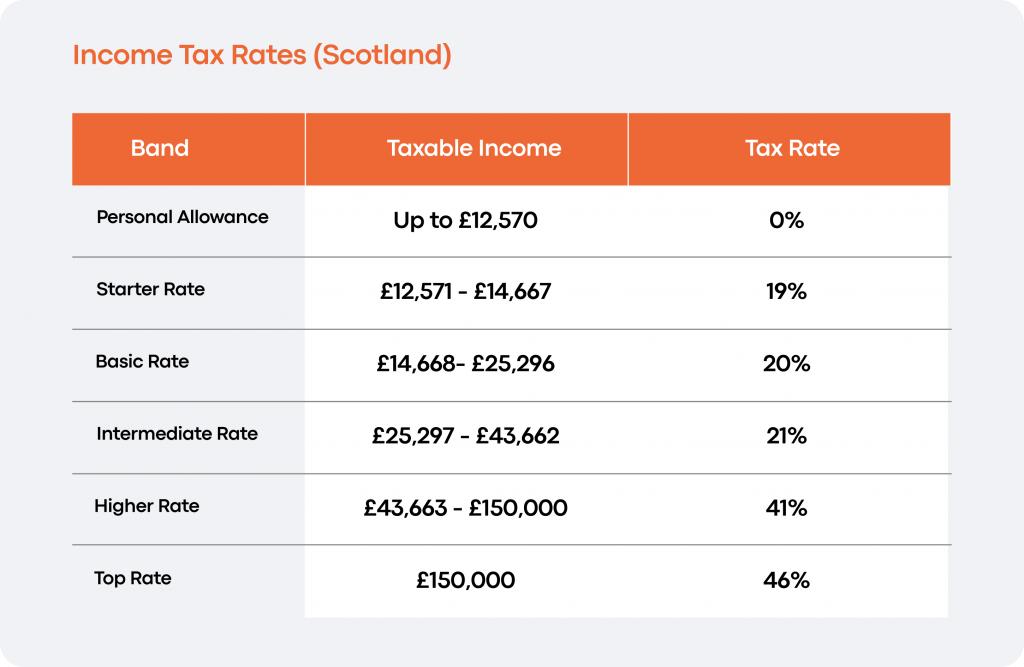

And here are the 2021/22 income tax rates for Scotland:

So in both of these cases, anything you earn over the taxable income is taxable at whatever the tax rate is for that band. For example, if you have an income of £42,571 in England, then £30,000 of that will be taxed at 20% (which works out as £6,000).

When you sell a property that isn’t your home – such as one that you let out – and have made a profit from it as a result, then you may need to pay capital gains tax. Capital gains tax is calculated by working out the difference in the price of a rental property from when you bought it and what you sold it for. If you bought a property for £100,000 and sold it for £200,000 5 years later, then you pay tax on your gross profit of £100,000.

You also need to take away any allowable expenses to get the net profit, including fees to solicitors, surveyors and estate agents, stamp duty at the rate when you purchased the property and any costs of improvements to the property. So if your total allowable expenses were £40,000, then your tax liability is now £60,000.

You can use HMRC’s tax calculator to work out exactly how much capital gains tax you’ll need to pay.

As a landlord, if you choose to do business as a limited company, as opposed to a private individual, then you may need to do the following:

As of April 2021, the government’s Making Tax Digital rules now apply to all landlords who operate as a VAT-registered business. These rules mean that these businesses (regardless of turnover) will need to use Making Tax Digital-compatible software when it comes to filing digital tax returns for VAT periods beginning on or after April 2022.

Put simply, landlords can claim expenses on anything related to the running and maintaining of their properties. Claiming expenses allows landlords to reduce their tax bills.

Listed below are examples of allowable expenses you can claim on:

Essentially, any expenses should be entirely incurred as a result of your property being rented out. As a landlord, you should definitely claim property expenses. Any money spent on these reduces profit, which reduces income, which reduces your tax liability.

A ‘replacement’ is classed as replacing or renewing something integral to a property (or a part of its fabric), such as part of the boiler, white goods for the kitchen or roof tiles.

Some of the items you can claim ‘replacement’ on include:

In order to claim this relief, you need to have bought the item and removed the old one. You can claim replacement domestic item relief when letting out a fully-furnished property. Though you can’t claim the cost of upgrading the item. To explain this a little further, if you replace a £500 TV with a £1000 TV, then you can claim the original £500 as ‘replacement’, but not the extra £500 as this would fall under an ‘improvement’.

An ‘improvement’ is an upgrade that adds extra value to your property, such as an extension or loft conversion. You can’t claim improvements as expenses for income tax reasons.

You can’t claim on any costs for buying a property, getting it into a rentable condition or making any other improvements. Instead, these expenses all count towards your capital gains tax calculation when it comes to selling the property.

You also can’t claim on travel costs between your home, office and any properties you rent out. Finally, you can’t claim wear-and-tear allowance on a property you aren’t letting as fully furnished.

No two landlords will pay the same amount of tax. It all comes down to your circumstances.

Generally speaking, landlords are usually in one of these tax positions:

As a landlord, you pay tax on your net rental income (which is your total income minus any of the allowable expenses we talked about earlier).

To work out your taxable profits, you should add and subtract the following:

+ Add all rent received

+ Add all allowable expenses

– Minus total expenses from the total rent

– Minus any capital allowances

= The sum of these is your taxable profit or allowable loss

If you have £500 a month rental income from your property and an annual salary of £25,000 then the example below will apply to you:

£25,000 annual salary + £6,000 taxable rental income (£500 a month x 12 months) = £31,000 total income

At a 20% tax rate, this works out as £1,200 tax payable on rental income.

Any expenses incurred from the property are a really important way of reducing any tax owed as these are deductible against gross rents received. What’s left from this total will be your taxable rental income.

The rules surrounding tax relief for landlords has changed a fair bit over the last few years. From April 2017, the amount of money that landlords could write off for tax purposes dropped by 25% year on year until April 2021. Research from Axa shows that 40% of landlords believe they’ll have to pay more tax as a result of these changes.

To help you better understand these changes, here’s a full breakdown of each and what they could mean for landlords:

Tax liability is the payment owed by an individual or business to a tax authority. Tax liabilities are incurred as income is earned. As we’ve gone over in this article, you pay tax when buying, letting or selling a property. The higher the value of the property and your overall income, the higher the tax bracket you’ll end up in.

Being able to properly manage your liability comes down to knowing exactly what you can and can’t claim as expenses. Keeping detailed and accurate records of your costs, being aware of changes and running any major decisions past a property expert will always keep you on the right side of HMRC.

Resooma is on a mission to add trust and transparency to the lettings market and can help agents and landlords get more qualified leads and better tenants. Request a callback to learn more about listing with Resooma.

All your utility bills in one monthly payment, split between housemates

Get a quote

All your utility bills in one monthly payment, split between housemates

Get a quoteFinding his article helpful? We’ve got plenty more helpful articles on there way. Join our Savvy Sunday mailing list