- minute read

- minute read

Council tax is a fee that goes towards paying for your local services. This cost is set by your council and is charged per household, rather than for every individual living in that house or flat. Discover more about what council tax is, what it pays for, whether you’re eligible for a reduction/exemption and how to work out what council tax band you belong in.

Council tax is a fee that your local council charges you for services it provides, such as rubbish collection, police and fire services, libraries and other education services. Generally, council tax is paid in 10 monthly instalments (with no payment being required in the following two months). Council tax is paid per household, rather than per person.

The amount of council tax you’ll have to pay depends on a few things:

In some cases, you may be able to apply for a council tax deduction. Some households are even exempt from paying council tax (more on this later).

Most people aged over 18 have to pay council tax, even if you’re renting (unless you’re a student). We’ve gone into some of the common exemptions for council tax a little later on.

Exactly who is responsible for paying within a household can get a little technical and confusing, so we’ve provided a hierarchy of liability to simplify this. Those at the top (number 1) are first responsible, whereas those at the bottom (number 5) are only responsible if nobody falls into the first four categories.

As we mentioned earlier, council tax funds several local services. These include:

One thing council tax isn’t used for is paying for health services of any kind.

How much council tax your household pays will depend on the value of your home and whereabouts you live (as different councils need different amounts of funding).

Find your local council and how much you’ll need to pay using the relevant link below. All you need to do is enter your postcode/click on your area. You’ll then be able to find relevant council tax information, along with contact details in some cases.

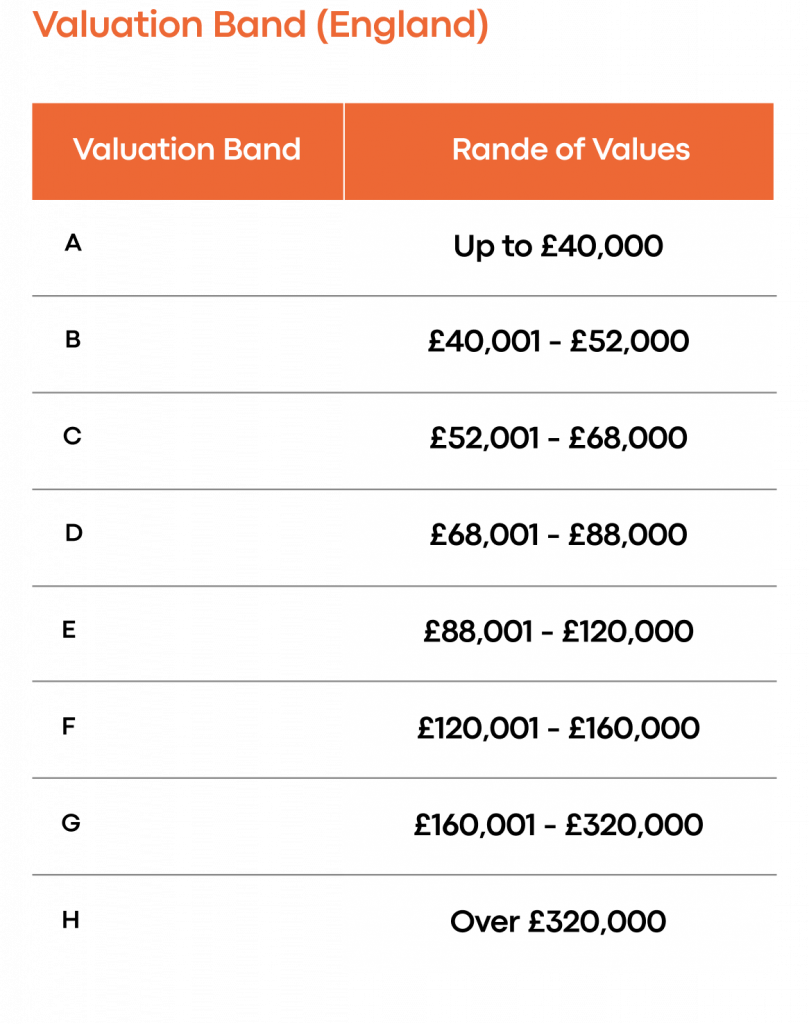

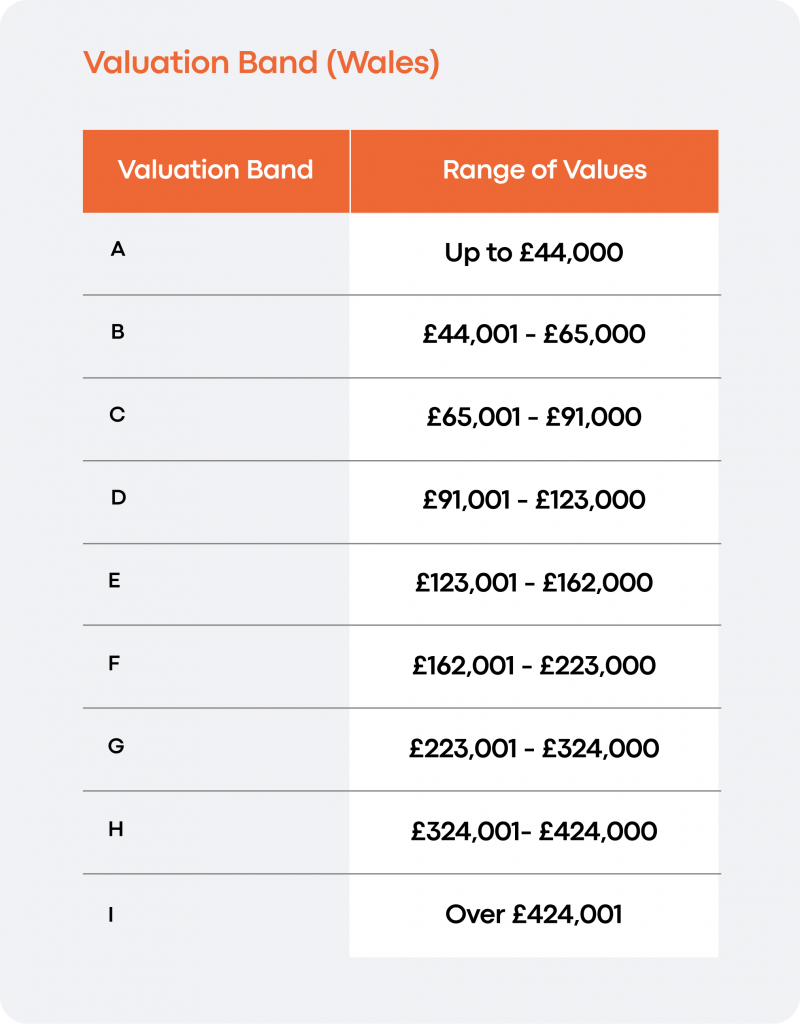

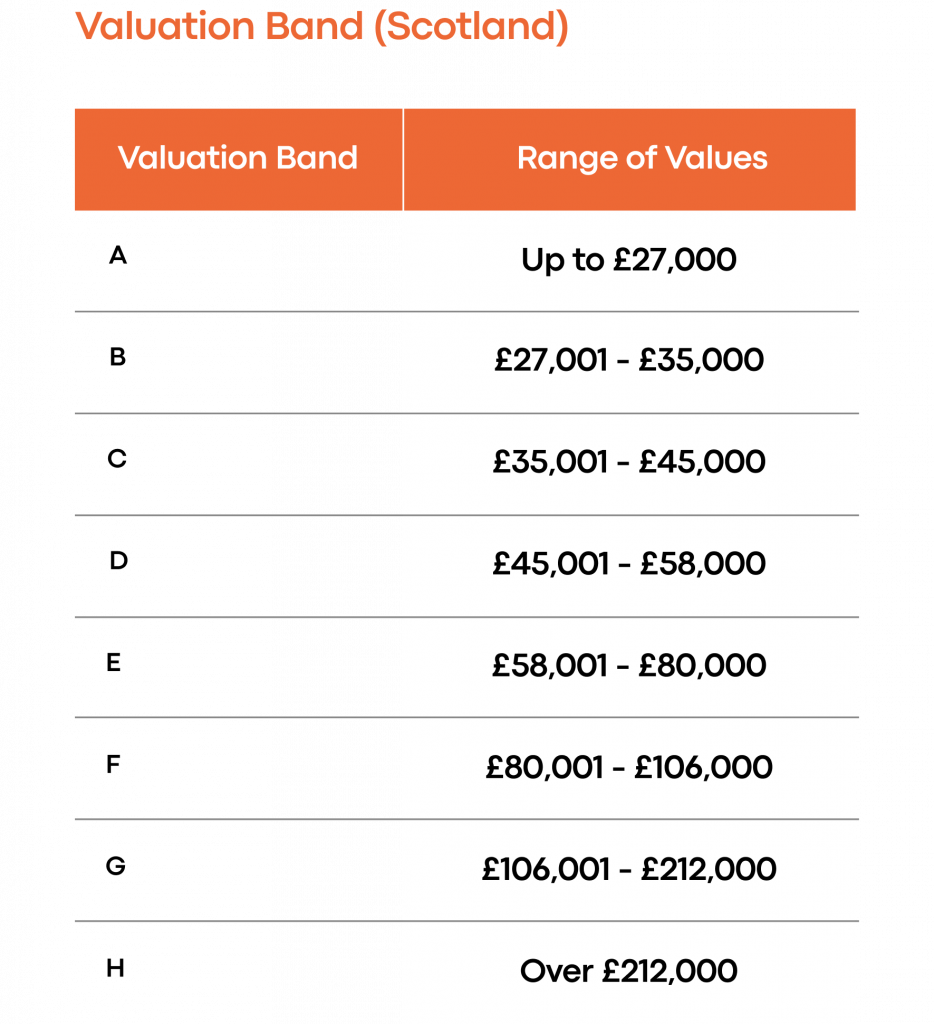

All homes are assigned a council tax valuation band by the Valuation Office Agency (VOA). This band is based on the value of your home. Each council keeps a list of all domestic properties in their area, along with its valuation band.

The valuation bands for England are as follows:

In Wales:

And in Scotland:

If you fall into one of the following categories then you might be able to get a reduction on your council tax:

Follow the links below to find out if you’re eligible for a reduction:

Check out our article to learn more about council tax refunds and reclaiming overpaid council tax.

Certain properties are exempt from council tax. These exemptions may be short-term or permanent. Properties that may be exempt include:

If your home falls into one of these categories but you’re still being charged, then get in touch with your council.

Here are a few other people that usually don’t need to pay for council tax:

If you think that your home is in the wrong council tax band and you’re overpaying on council tax as a result, then you might be entitled to get a refund.

What you’ll need to do is get your property reviewed. Just be aware that this could also lead to the property ending up in a higher council tax band. Contact the Valuation Office Agency (VOA) and ask them to review your band.

They’ll probably ask for evidence that proves your council tax band is wrong – so be sure to have this ready. If they agree to review your band then you should get a decision either way within 2 months.

If you have a complaint about your council tax – such as thinking you’re paying more than you should be – then you need to directly contact the council first. It shouldn’t take any longer than 12 weeks to resolve the issue.

If you’re unhappy with the decision or feel the council is taking too long, then another idea is to take your complaint to the Local Government Ombudsman.

If you aren’t happy with the result of a complaint to your local council, then the next step is writing to the valuation tribunal and appealing that way. The valuation tribunal is an independent body which usually consists of 3 members that’ll listen to your appeal (this process doesn’t cost).

You’ll be given at least four weeks’ notice of the hearing. If possible, you should attend in person as this will give the best possible chance of the case going in your favour.

The valuation tribunal will consider both sides of the case before making a decision and what needs to happen (such as whether your property needs moving into a different tax band or whether you should be refunded).

Most people pay their council tax over 10 monthly instalments. They then don’t pay anything in February and March. If you’d rather pay every month though, then just ask your council – it shouldn’t be an issue. Some people prefer monthly payments as this can make budgeting easier.

When it comes to council tax, falling behind on even one payment can end up being quite serious. You may end up being asked for the full year’s payment upfront if you don’t quickly resolve the issue.

If you’re having financial difficulties and think you might miss a payment, then we’d recommend getting in touch with your council ASAP. Being open and honest will make them much more likely to be cooperative with you.

It all comes down to individual councils. Some will let you make a payment slightly late, whereas others may end up increasing future payments to make up for the missed ones.

Already sorted your house but need to set up bills? We can help with this too – we set up and split utilities for you. Get a free quote for your utilities here.

All your utility bills in one monthly payment, split between housemates

Get a quote

All your utility bills in one monthly payment, split between housemates

Get a quoteFinding his article helpful? We’ve got plenty more helpful articles on there way. Join our Savvy Sunday mailing list