- minute read

- minute read

For most students, the maintenance loan will be their main source of income while at uni. But exactly how does the student maintenance loan work? And how much money are you going to get from it? In this article, we’ve answered that question and several other key queries to help you fully understand how student loans work.

Maintenance loans are a type of student loan provided by the government. Their purpose is to help students get by while they’re at university, covering essential living expenses like rent, bills, food and big nights out.

While you apply for a student maintenance loan in the same way that you’d apply for a tuition fee loan, they’re still counted as two separate types of funding. Because the current repayment terms on student loans are actually pretty manageable (we’ll be going into this in more detail later), we’d recommend taking out a tuition fee loan and student maintenance loan for your time at university.

What’s great about the student maintenance loan is that once you’re set up, it arrives straight into your bank account. In England, Wales and Northern Ireland, this appears in the form of three large and (almost) equal instalments across the academic year. In Scotland, you’ll receive the loan in monthly payments.

While you’re directly sent your maintenance loan, you won’t see any of your tuition fee loans, as they’ll be sent straight to your university.

The vast majority of undergraduate students are eligible to receive funding in the form of a maintenance loan. To make things clearer, we’ve run through the factors that determine if you qualify for a maintenance loan.

Your university or college needs to be classed as a recognised body. This means that it’s able to award degrees. Your course also needs to fall under the list of qualifying courses supplied by the government. This list is pretty extensive and covers practically everything, particularly when it comes to studying full time.

If this is the first higher education course you’re enrolling on then you should be eligible to receive a maintenance loan.

Aside from this though, there are a few slightly more complicated grey areas. If you previously started a course but had to drop out then you might be eligible to receive funding again.

Students are eligible to receive funding for the number of years the course they’re applying for lasts, plus one extra year. So if you previously studied and are now applying for a maintenance loan for a new course, you’ll need to subtract the number of years you previously studied from this figure to see how much longer you’ll be eligible for.

Although, if you dropped out for ‘compelling personal reasons’ – such as serious illness – then you might still be eligible to receive funding for your entire course, regardless of how long you previously studied for.

If you’re 60 or over, age restrictions can come into play. Even in this case, you might still receive some funding if you’re studying full time. It’s pretty unlikely that this one will pose a problem for you.

We’re getting into some murky territory here so it’s important to pay close attention. You should be eligible to receive a maintenance loan if you’re a UK national (or have ‘settled status’), you live in the UK, Channel Islands or the Isle of Man and have done so for the three years before your course start date.

All of these things need to apply to guarantee your eligibility. There are numerous stories of students who were born in the UK but moved country as a child and assumed they’d be eligible for a maintenance loan as a UK citizen. Unfortunately for them, this isn’t the case.

With that being said, you shouldn’t get too bogged down in these criteria. The fact remains that almost all students in the UK will be eligible to get a maintenance loan. If you’re still unsure, then consider contacting your funding body for clarification.

The size of maintenance loan you’re entitled to will depend on the following three factors:

Regardless of how big a student loan you receive, you can make it go further by following some handy student budgeting tips.

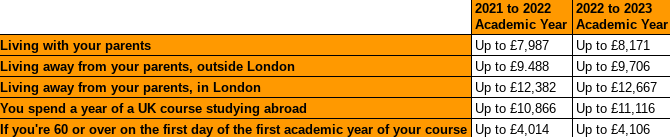

Below, we’ve broken down maintenance loans for living costs.

Remember – Your maintenance loan is provided by the part of the UK you normally live in, rather than where you’ll be studying.

Next up, you can find a detailed breakdown of maintenance loans in England for 2021/22.

You can use the above table to give a pretty accurate idea of how much maintenance loan you stand to receive at university.

The household incomes in bold represent the upper earning thresholds for the parents of students in each living situation:

In Wales, the highest maintenance loan you can receive is £12,930 (for students living away from home in London), whereas the lowest is £8,790 (for students living at home).

Wales differs as students with different household incomes still get the same amount of money. What then happens is that students with a lower household income receive more of their money as a non-repayable grant, while students from higher-income households will get a large portion of their money as a loan that needs to be repaid.

Things work a little differently in Scotland, with there being four household income bands that determine how much maintenance loan you’ll get. The maximum package is £7,750 (for households earning £20,999 or less) whereas the minimum amount is £4,750 (for households earning £34,000 or more).

In Northern Ireland, the highest maintenance package is £8,368, whereas the lowest is £2,812.

Here, maintenance loans and maintenance grants are rolled into one lump sum that students receive together. For the £8,368 package, £3,475 is a maintenance grant (which doesn’t need to be repaid), whereas the other £4,893 is a maintenance loan (which needs to be repaid).

Across England, Wales, Northern Ireland and Scotland, the easiest way to apply for your maintenance loan is online. You can apply via post in England, Wales and Northern Ireland as well but let’s be honest, who has the time for that?

During your application, you’ll probably be required to provide some supporting documentation to prove your identity. These could include passports, birth certificates, driving licences and so on.

If you’re ready to apply for your maintenance loan then here are the links:

When you receive your maintenance loan depends on whereabouts in the UK you live and when your university’s term officially starts. To receive your first payment (which is usually in September), you’ll need to be registered for your course.

Students from England, Northern Ireland and Wales will receive their maintenance loan in three parts throughout the academic year. Generally speaking, these will arrive in September, January and April (but as we said, this depends on the start dates of your university semesters).

Things are a little different in Scotland. There, your loan is paid on the 7th of each month. You won’t receive three large payments, but getting more regular monthly payments does make student budgeting easier.

Thankfully, you don’t have to start paying your student loan back as soon as you’ve graduated. In fact, you’ll only have to start paying it back once you’re earning a certain amount (this applies to tuition fees and the maintenance loan).

Here are the current repayment thresholds for UK graduates (how much you need to be earning before you’ll have to start paying back):

Once you’re earning above the relevant amount, you’ll then pay 9% of anything on top of it. For example, if you earn £30,295 then you’ll need to pay 9% of £3,000 – which is £270 a year.

For students in England and Wales, the interest rate on maintenance loans can be as high as 4.5%. While you’re at uni, interest will be at this maximum 4.5% rate, but once you’ve graduated, the amount of interest you’re charged can vary between 1.5% and 4.5% (depending on how much you’re earning).

It’s a much simpler (and more generous) system in Northern Ireland and Scotland. Right now, maintenance loan interest rates are set at 1.1%.

These numbers are worth keeping an eye on though, with inflation causing regular changes in the amount of interest students are being charged.

Regardless of how much (or how little) maintenance loan you’ve paid back, the entire balance is always wiped off after around 30 years.

If you’re from England, Scotland or Wales then your loan is cancelled 30 years after you first became eligible to begin repaying it. In Northern Ireland, this length of time goes down to 25 years.

Your loan is also written off if you have to claim a disability-related benefit and are no longer able to work.

Already sorted your house but need to set up bills? We can help with this too – we set up and split utilities for you. Get a free quote for your utilities here.

All your utility bills in one monthly payment, split between housemates

Get a quote

All your utility bills in one monthly payment, split between housemates

Get a quoteFinding his article helpful? We’ve got plenty more helpful articles on there way. Join our Savvy Sunday mailing list