- minute read

- minute read

Receiving that sweet sweet text from Student Finance stating that the money will be in your account soon is the best feeling! However, with the cost of living crisis and the price of everything going up, it’s a wonder how you can stretch your student loan to last until the next amount drops. This blog post aims to help you budget your student loan using out student budget calculator, and to give you some tips on how to make it last that little bit longer.

Navigate this article:

The maximum student loan amount you can get depends on where you live and your household income. If you live in England, you can apply through Student Finance England, if you live in Wales, you can apply to Student Finance Wales. If you live at home with your parents, for the academic year 2024 – 2025 you could receive up to £8610. If you live away from your parents, you could receive up to £10,227. You may also be eligible for grants, bursaries, sponsorships or scholarships that you can apply to through your University, which can help top up your student finances.

It’s also worth noting that in your final year of study, you will receive less student loan. This is because, during the study, student finance covers the break between academic years, and students are no longer entitled to financial support once their course has ended

Creating a budget is important as it can help make your money last longer. It makes sure that you prioritise paying for the important things like rent and bills. Many students, and adults, can relate to falling short of money each month. That’s why budgeting is so important. It can hold us accountable for the things we need to spend money on, whilst also making sure we have money left over to spend on the things we want to spend on. That’s where a budget calculator can come in handy…

To begin budgeting as a student at university, here are a few steps to go about devising a budget:

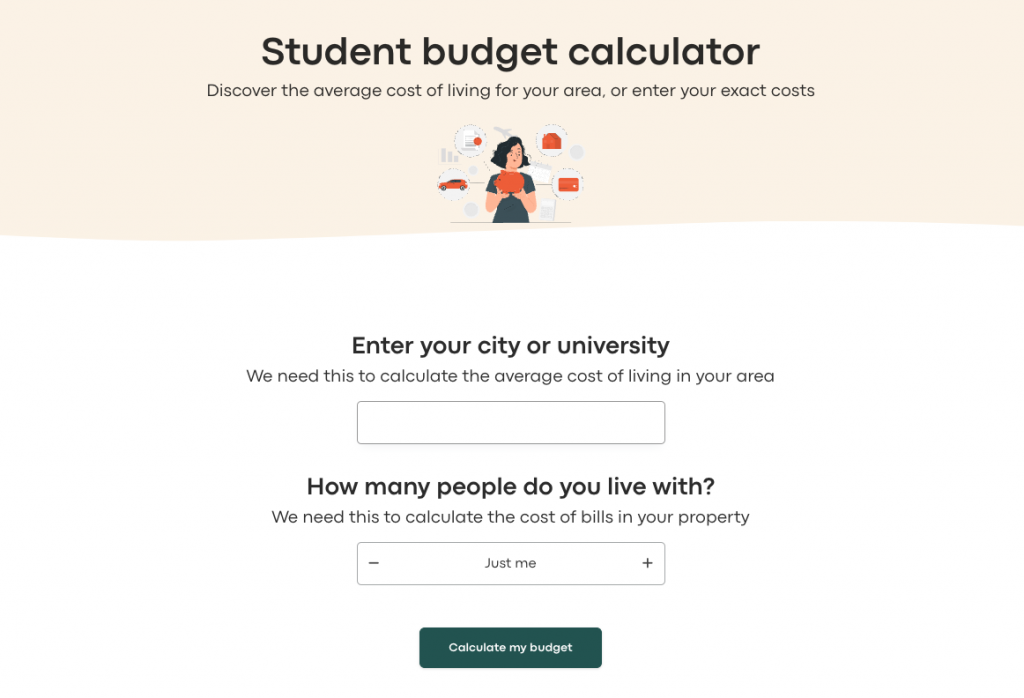

To save time and make budgeting easier, you can use Resooma’s free student budget calculator. You can make it specific to the university or area you are living in, and it will give you an estimate of the cost of living in that area. You can then fill out the relevant amounts for your rent, bills, food shop and other activities and Resooma will calculate your monthly budget

You may have heard of the 50-30-20 rule. The idea behind it is to spend 50% of your income on needs, for example, your rent and groceries, 30% on wants, like eating and drinking out, and save the other 20%

To work out these percentages based on your student loan, split your student loan into 3, to cover the three months of the term, and from that amount, you can complete the 50-30-20 rule. Split this total into 3 amounts, one worth 50%, one worth 30% and the other worth 20%. You will now have a rough idea of how much money should be spent across needs, wants and savings each month

The reason students may find this type of budgeting difficult is that it could be hard to save 20% of the student loan if you have a low amount and live in a particularly costly area, like London. But it’s always handy to have a safety buffer in place when working out your finances, and Resooma’s student budget calculator calculates your disposable income for you, letting you know how much you could have left over each month

Students in the UK receive lots of perks and discounts at tons of shops, supermarkets and restaurants.

One of the BEST things to sign up for as a student is the FREE TOTUM Card. This will unlock over 400 discounts and deals, allowing you to save that extra bit of student loan every month. You can save money on travel and grab a 16 – 24 railcard which gives you 1/3 off train tickets, and if you are living in London and own an Oyster card, you can also link your railcard to your Oyster card, saving you money on the underground too!

To get more money-saving deals each week, you can sign up for Resooma’s Savvy Sunday newsletter. Every Sunday you’ll receive the week’s latest deals and money-saving tips straight into your inbox. There is an email sign-up at the bottom of this blog post.

And speaking of Resooma, If you’re already a customer, you can earn gift cards by referring your friends and family to the bill-splitting service. Send them your referral link which is located in your dashboard, so you can take the stress out of bills and save your student loan by spending the gift card vouchers instead.

One last way to make your student loan last longer is by topping up the amount with a side hustle. Side hustles are a great way to make a little extra cash for not much work. We recently wrote a blog post all about the best student side hustles, which you can read 👉 here 👈

Already sorted your house but need to set up bills? We can help with this too – we set up and split utilities for you. Get a free quote for your utilities here.

All your utility bills in one monthly payment, split between housemates

Get a quote

All your utility bills in one monthly payment, split between housemates

Get a quoteFinding his article helpful? We’ve got plenty more helpful articles on there way. Join our Savvy Sunday mailing list