- minute read

- minute read

When living in a rental property, knowing which bills are and aren’t your responsibility can often be a little confusing. We’ve listed all the bills you’ll need to pay when renting – and a couple that are your landlord’s responsibility.

To summarise, here are all the bills you may need to pay when living in rented accommodation. The majority of these will be paid on a monthly basis, though one-time annual payments are often an option as well.

And don’t forget your rent! It goes without saying, but the monthly rental payment will always be your largest outgoing. In some parts of the country – particularly the south of England and Greater London – rent alone takes over 50% of a tenant’s monthly earnings.

Below, we’ve explained the ins and outs of these bills in greater detail.

When living in a rental property, you’re usually required to pay the gas and electricity bills, along with water. In some cases though, rented accommodation is classed as ‘bills included’, meaning that these payments have been rolled in with the monthly rental cost.

If gas and electricity are your responsibility, then you can shop around to try and find the best deal. This isn’t an option with water however. You’ll either be on your provider’s standard tariff or have a water meter, meaning you’ll only be charged for the amount of water you use.

You can save yourself a huge amount of time and effort by getting a bills-included rental package. Resooma sets up and bundles together utilities, Wi-Fi, TV and council tax into one simple monthly bill.

Average UK energy bill (gas and electricity) for a three-bedroom house = £1,163 per year and £97 per month

Average Annual UK water bill for a three-bedroom house = £353.00 per year and £29.40 per month

Though these costs may seem a little steep, there’s plenty you can do to save money on your energy bill.

This is a form of tax that’s paid directly to your local authority to be spent on services like the police, housing and education. The exact amount of council tax you pay depends on a few things, including the value of your home and where you live. In England and Wales, there are eight different council tax bands, with each of these being for different property values. For more information, you can find out your council tax band here.

If you’re a student then we have good news – students are exempt from paying council tax!

Average UK cost for a Band D property = £1,898 per year and £158 per month

It’s the tenant’s responsibility to pay for a TV licence when renting. Though they aren’t essential, a TV licence is needed when watching or recording live TV broadcasts, along with when watching any programme on BBC iPlayer (even if it isn’t being broadcast live). Because of this, we’d usually recommend getting your household a TV licence.

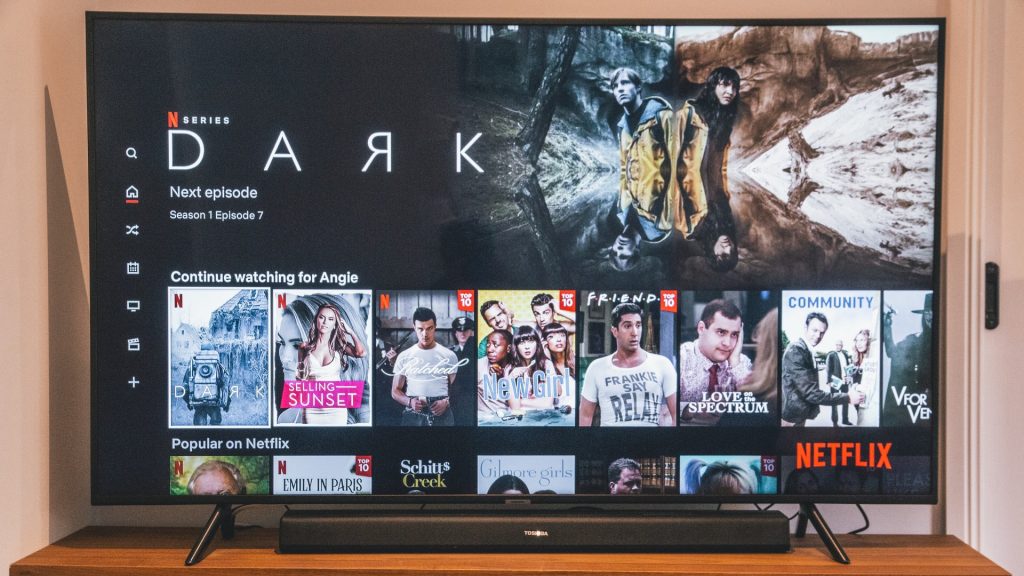

However, there are some loopholes when it comes to TV licences. For example, streaming and on-demand services like Netflix and NowTV don’t require one. Another interesting loophole is that a TV licence isn’t required when watching live TV from a device that’s powered by its own batteries and not plugged into a socket (such as a laptop or phone). Although, this only applies when your parents do have a TV licence at home.

Average UK cost per household = £159 per year and £13.25 per month

Nowadays, the vast majority of people don’t actually have a landline, so most renters will probably only require broadband. To find out what speeds and coverage you can get, we’d recommend using a broadband postcode checker.

There are a few different ways to try and save money here. For one, it makes sense to get an ‘unlimited data’ broadband package when living in a shared house. This will help you avoid going over your monthly data download limit. It’s also often cheaper to build your broadband into a package with your TV and phone, rather than paying for each of them separately.

A basic fibre package and phone line will cost around £25 a month, while the UK average is just over £30 a month. You’ll usually end up paying the most when choosing one of the main providers, such as Sky and BT.

Average UK cost per household = £363.60 per year and £30.30 per month

Contents insurance is a type of policy that protects your household items against any damage from various causes, including fire, water and storms. If your items were to suddenly break, then replacing them can be really expensive. Contents insurance removes any worries surrounding broken or stolen items. It isn’t essential, but we’d strongly recommend it in a rented home.

To quote Getsafe – one of the most popular contents insurance providers out there – “If you picked up and turned the house upside down, we cover everything that would fall to the ceiling”.

Contents insurance is usually pretty cheap, with many policies starting from as little as a few pounds per month.

Get £15* credit on your account when you sign up to Getsafe through our link!

Average UK cost per person = £125 a year and £10.40 per month

Sometimes, tenants will have to pay additional service charges linked to the property’s upkeep. This could include gardeners or cleaners who make weekly/monthly visits to the property.

Luckily, this isn’t something that tenants are usually charged for. Most landlords and letting agents will include any service charges within the overall monthly rent price so it doesn’t feel like a separate cost.

Because they own the property, landlords are required to pay for buildings insurance. This is a form of coverage that protects the structure of the home, along with any permanent fixtures and fittings. If the property you’re living in suffers from any major damage or burns down, then the owner will receive money to repair/rebuild.

Though the majority of repairs are the landlord’s responsibility, this doesn’t mean that you should expect them to deal with everything. The repairs they’ll prioritise and pay for are ones that could affect the health and safety of their tenants – such as any leaks, mould or faulty heating. Any repairs that they don’t regard as essential – such as creaky floorboards – probably won’t be dealt with any time soon.

If any required repairs are your fault – like a broken window or piece of furniture – then you or another tenant will be liable to pay for these repairs.

Already sorted your house but need to set up bills? We can help with this too – we set up and split utilities for you. Get a free quote for your utilities here.

All your utility bills in one monthly payment, split between housemates

Get a quote

All your utility bills in one monthly payment, split between housemates

Get a quoteFinding his article helpful? We’ve got plenty more helpful articles on there way. Join our Savvy Sunday mailing list